Overview

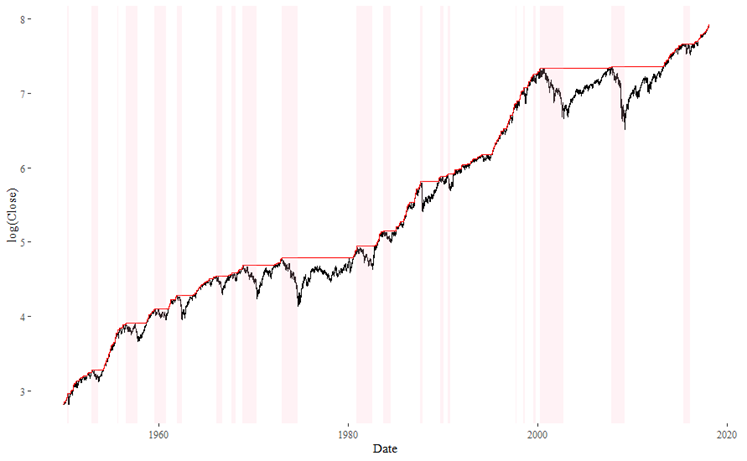

Large stock market drawdowns occur all the time. The chart below shows the S&P 500 over the past 70 years:

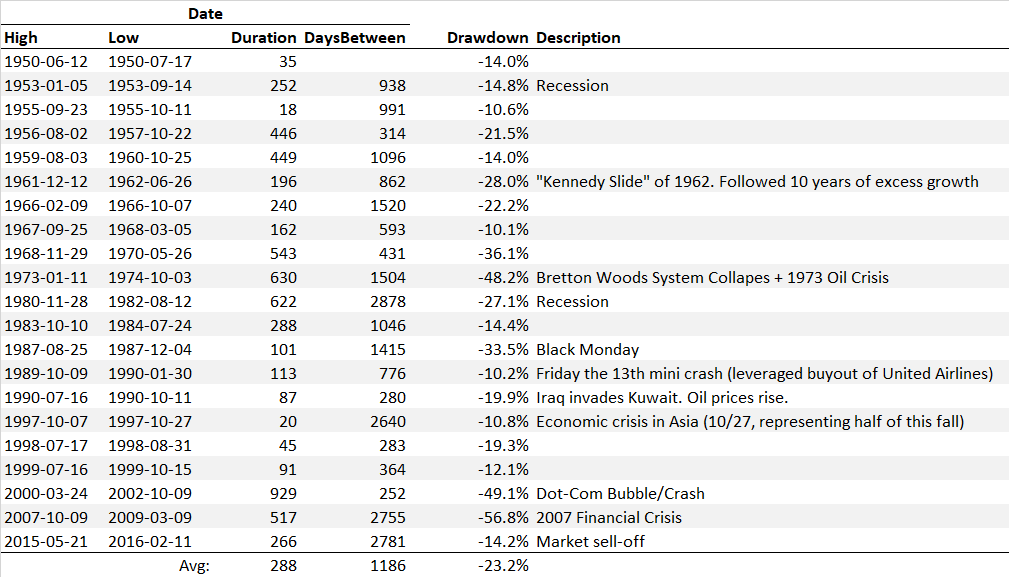

The shaded periods indicate drawdowns where the market fell by 10% or more. Each of these drawdown periods is detailed in the next table:

On average, a drawdown of this size occurs every 1,187 days (4.74 years). They can occur as little as a year apart or as much as 12 years. But the overall message is: these are not rare occurrences. In fact, they occur quite frequently and can wipe out multiple years of profits all at once.