Blog Entries options

2 Posts

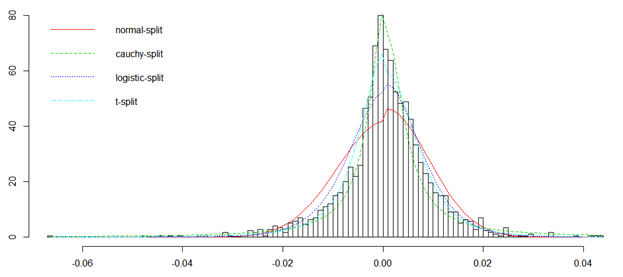

The attached paper looks at real-world options pricing data and tries to use this to infer the probability distribution of expected returns. The method proposed does not seem to be ideal, but it provides one method for looking at options prices to see if these can be used to predict future prices and is able to produce sensible predictions for the value of the stock examined.

A t-distribution and a "split" t-distribution are shown to be good models for stock returns. A distribution is fit to real-world data and used to infer theoretical prices for call and put options. These theoretical prices are compared to market prices and differences are discussed.